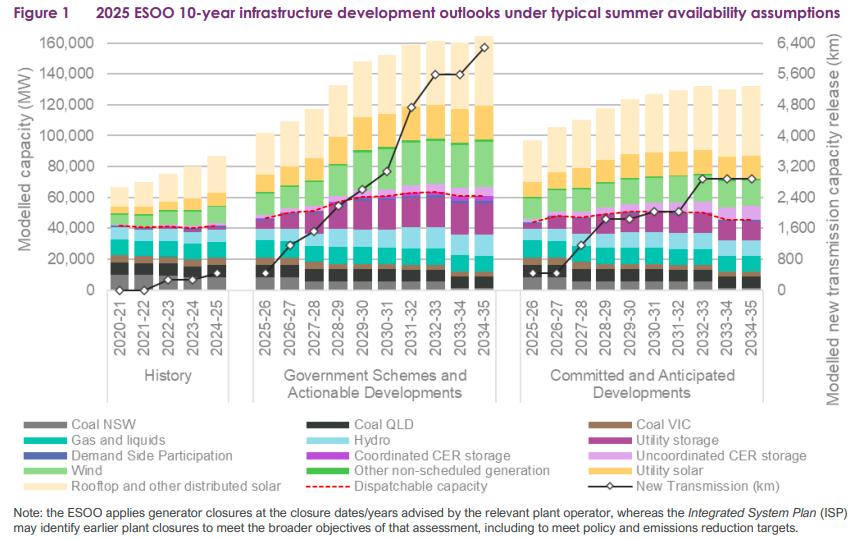

AEMO have released their latest annual Electricity Statement of Opportunities (ESOO) report, providing a 10-year outlook of the National Electricity Market (NEM) and identifying investment needs in generation, storage, transmission, and consumer energy resources to maintain reliability during the energy transition. Here are some of the key points.

Compared to last year’s ESOO, forecast reliability has improved, helped by more than 10 gigawatts (GW) of additional projects that now meet AEMO’s committed and anticipated criteria (2.9 GW/7 gigawatt hours of utility storage, 4 GW of grid-scale solar and 3 GW of wind).

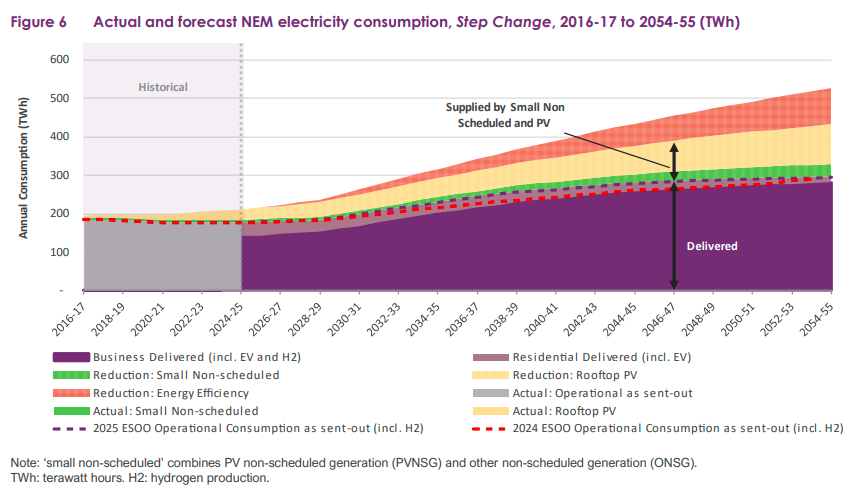

Electricity consumption is forecast to increase 28%, from 178 terawatt hours (TWh) to 229 TWh, predominantly driven by the rapid expansion of data centres, the broader inclusion of prospective industrial load and accelerating business electrification.

Supply Developments: New generation and storage commissioning must accelerate to 5.2–10.1 GW annually over the next five years (up from 4.4 GW in 2024-25). Delays to projects (common in recent years) represent a material risk to supply security.

Reliability Risks: Qld (80 MW reliability gap forecast for summer 2025-26 due to demand growth and slower project commissioning); SA (390 MW gap forecast in 2026-27 with Torrens Island B retirement and EnergyConnect delay); NSW (reliability gaps previously linked to Eraring closure no longer forecast but system security remains a challenge); Vic (gaps tied to Yallourn closure no longer forecast, though gas supply and outage management risks persist).

Major Retirements: Torrens Island B (SA, 2026), Eraring (NSW, 2027), Yallourn (VIC, 2028). Replacement capacity must be delivered ahead of these closures.

System Security Requirements: As synchronous coal plants retire, new services are critical (system strength, frequency control, ramping capability, and restart services). Consumer energy resources (rooftop PV, batteries, EVs) must be effectively coordinated under the National CER Roadmap to avoid operational challenges.