Australia’s east coast and WA electricity markets both recorded higher operational demand in Q3 2025, reflecting colder conditions, increased battery charging, and significantly less high-price events. However, strong renewable generation growth and subdued gas use helped contain price volatility across the National Electricity Market (NEM).

Here are some of the key insights from the Australian Energy Market Operator’s (AEMO) most recent Quarterly Energy Dynamics (QED) report.

Demand and Generation Mix

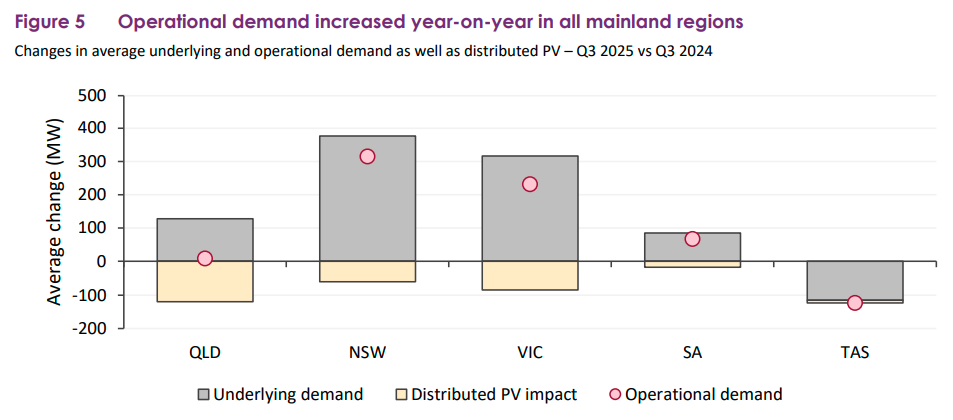

- Operational demand in the NEM rose 2.3% year-on-year, underpinned by record underlying consumption and growing battery load.

- Distributed solar PV continued to offset daytime grid demand, setting new low demand records in several states. Despite this, higher evening peaks and electrification trends kept total system demand elevated.

- Renewable generation continued its rapid expansion, with wind and large-scale solar output up 16% year-on-year, and batteries discharging 150% more energy to support evening peaks.

- Renewables supplied a record 42.7% of total generation, driving emissions intensity to a new low of 0.57 tCO₂-e/MWh.

- Coal output edged slightly lower overall, while gas generation declined 11% amid lower evening peaking needs.

Wholesale Electricity Prices

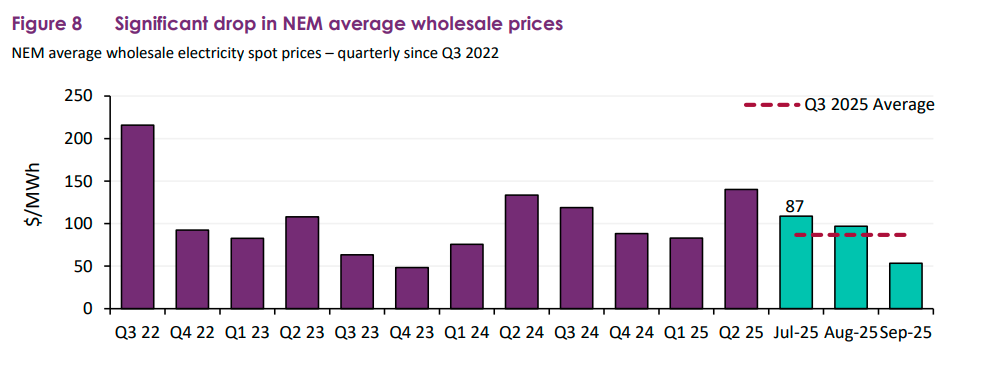

- Wholesale electricity prices fell across all NEM regions, averaging $87/MWh. The key drivers were:

- A stronger renewable generation share displacing high-cost peaking plant.

- Subdued volatility, with high-price events (> $300/MWh) down 82% year-on-year.

- Lower fuel input costs and improved inter-regional transmission flows.

- Queensland recorded the lowest average price at $72/MWh, while South Australia remained the highest at $104/MWh, reflecting greater exposure to intermittency and lower firming reserves. Negative or zero-price intervals surged, especially in Queensland, highlighting ongoing pressure on midday market pricing.

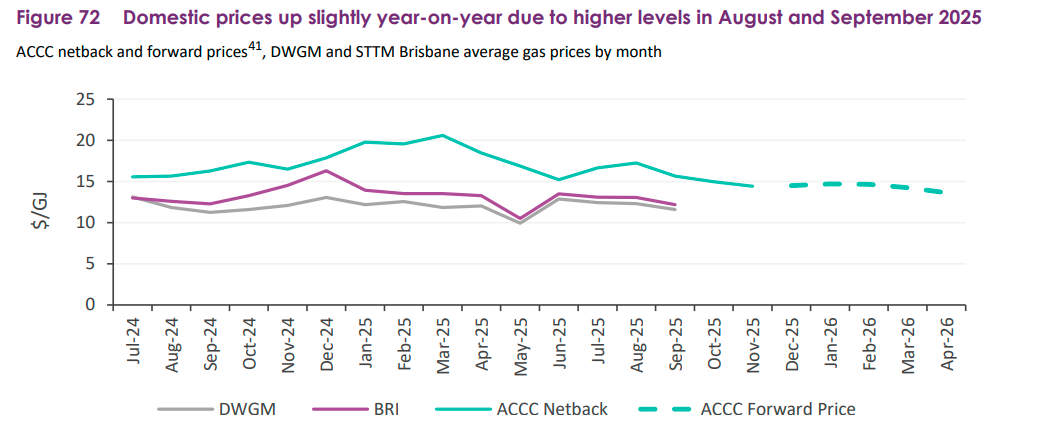

East Coast Gas Market

- East coast gas largely stable on the year.

- Demand softened marginally due to reduced gas-fired generation and LNG export volumes. Domestic supply, however, declined more sharply as Queensland export projects and the Moomba plant curtailed output, increasing reliance on the Iona underground storage facility, now at its lowest Q3 inventory since 2021.

- Tight supply margins and limited new field development continue to underpin medium-term gas price risk.

Western Australia

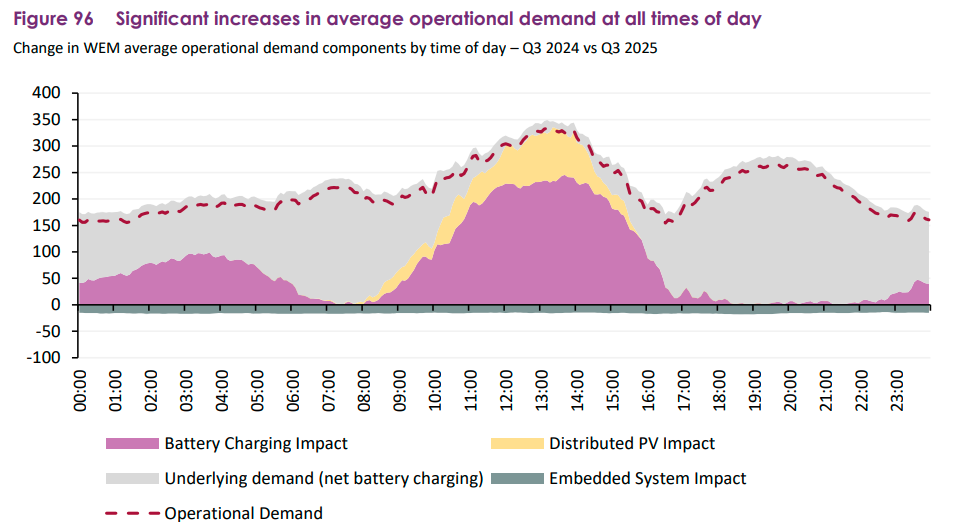

- In the WEM, operational demand rose 11% and renewable output hit a new Q3 record at 36.4%.

- Average wholesale electricity prices increased 27% to $101.76/MWh, driven by higher load and fewer mid-day low-price periods.

- Domestic gas production reached its highest level since 2020, offsetting a modest fall in consumption.